A funny thing happened along the way to the 21st century. Payment methods didn’t change much for decades. Then along came Apple Pay.

First, we humans bought what we needed with cash. Often, that meant we had to save up enough money to buy what we wanted. Second, big banks and smart people came up with a way for us to buy what we wanted with plastic and mobile debt-making devices were born. Now, there’s a new kid in Money Town and his name is convenience.

Usability Rules

Apple and the company’s many technology gadget competitors know about this awful truth. Apple’s customers use their devices more than other devices. We use Mac, iPhone, and iPad more. We buy more. We buy and use more applications. We take more photos and movies. We buy and listen to more music.

The Apple Usability Syndrome is born from one basic fact. Apple’s products– all of them– are more usable, friendlier, simpler, and more effective for customers than are competitors. Usability matters, folks.

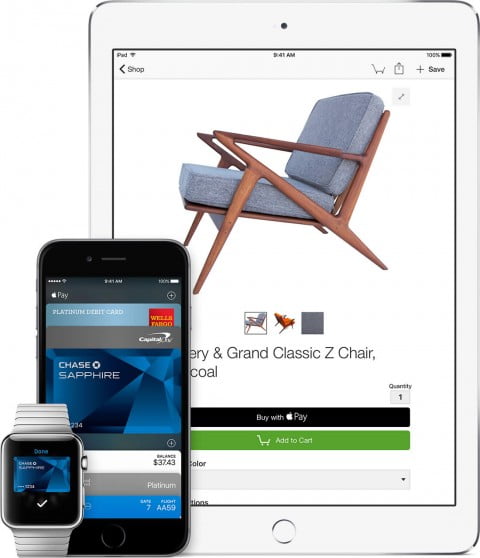

One perfect example of the usability syndrome is in the most recent Apple product that has failed to excite the critics but has customers feeling pleased and has started a trend among retailers. Apple Pay. Name another mobile payment device (not your credit card; we’re talking high tech here) that gets used more than Apple Pay. Yet, consider the limited number of devices which make Apple Pay work.

In stores and online, it just iPhone 6 and 6 Plus, iPhone 6s and 6s Plus, and Apple Watch (and a bunch of iPads which only use it within apps online).

Here in Brooklyn where I live and in Manhattan where I work Apple Pay is growing in usage, both among merchants and Apple customers. It’s no longer rare to see Watch being used to buy something at Macy’s or Starbucks or McDonalds or a gazillion of the merchants that line the streets.

What is rare is to see someone using Samsung Pay or Android Pay, yet both have far more devices, and, ostensibly, a gazillion more users than anything with an Apple logo on it. What gives?

It’s the Apple usability syndrome. We Apple customers actually use our products; Mac, iPhone, iPad, Watch, or whatever.

When I first started using Apple Pay it took some effort to find a merchant that could accept my car on a terminal. Then, one by one, more merchants joined in. And another trend set it. I would tell merchants that did not have Apple Pay on their system that I would shop elsewhere (much the same way as looking for a car manufacturer that has Apple’s Car Play vs. one that does not). Apple says more than 2-million merchants are signed up for Apple Pay, and while that number seems large and is growing fast, it’s a drop in the bucket of the number of merchants who are not ready for wireless payment systems.

That will change in the next couple of years as new wireless and chip-based credit card systems make their way into most merchant stores, so the handwriting is on the wall.

This usability syndrome carried over from iPhone to Watch. Previous Apple Pay purchases required me to fish around for my iPhone, point it toward the wireless terminal, wait for the credit card to pop up, and then press my finger onto the Home button to complete the secure transaction. Yes, that is much easier than fishing around for a credit card, vastly more secure, but is nothing compared to using Apple Watch. No. More. Fishing. What is not to like.

Apple may not end up with the most number of mobile wireless pay customers, but I’m willing to bet that iPhone and Watch customers will use Apple Pay more, on a per customer basis, than Android Pay or Samsung Pay or Whatever Pay comes along. Smart banks and smart merchants know that and will respond accordingly.

Remember, Apple has over 1-billion iOS devices in use these days. That ain’t Facebook or Android, but it’s a huge number with a lot of buying power and a history of usability that goes beyond the competition.

Leave a Reply